Twinfield and Making Tax Digital (MTD)

VAT-registered businesses with a taxable turnover above the VAT threshold are required to use the Making Tax Digital service to keep records digitally and use software to submit their VAT returns from 1 April 2019.

We have introduced new functionality to submit VAT return with Twinfield under the new HMRC rules.

Settings

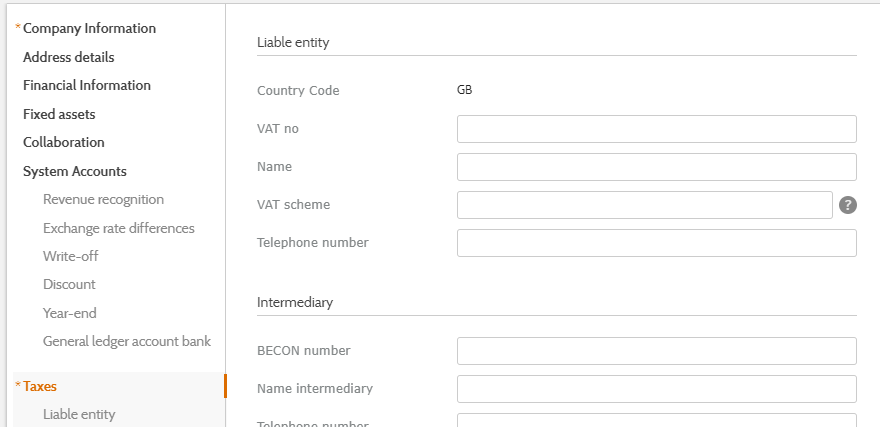

- In company settings, you have to enter the VAT scheme(s) the companies uses. Go to Settings > Company Settings > Company Settings, section Taxes: Liable entity. This field is necessary to be compliant to MTD.

- When the company is registered for MTD then the VAT return needs to be submitted via the MTD Gateway. Therefore you need to create a new type of gateway via Gateway settings: VAT > Gateways. Select the HMRC MTD gateway. This type of gateway is only visible when the company has country code GB.

- When you save the new HMRC MTD Gateway a link will be shown to authorise at HMRC. Please note you need to register the company for MTD at HMRC. In case you are an agent you can register multiple companies after approval of the business.

- Click on the link to open up the HMRC login pop-up.

- Enter your credentials, as provided by HRMC and grant authority at HMRC for this gateway.

- After a successful authorisation, the status has been changed to Authorised.

- Define whether you are an Agent of Business. Part of being MTD compliant is reading a message when submitting the VAT return to HMRC. The type of message depends on this setting.

This new gateway can be set as default gateway via Settings > Company Settings > Company Settings section Taxes: Communication.

Please note that when you want to ungrant the authority then you need to unregister from MTD via HMRC, so not via the software. Once that is done, your credentials are not valided anymore and you will receive a message the VAT return has been rejected due to the fact the user is not authorised.

VAT Return submissionThe way the VAT return is created and submitted to HRMC, has not been changed. Except the following:

- It is not possible anymore to edit the amounts of the VAT return before submitting the VAT return to HRMC.

- When you are MTD registered then you can only use a MTD gateway to submit your VAT returns. Other type of gateways cannot be selected.

- It is only possible to submit the VAT return for an obligation which is open at HMRC. When the obligation is not open or already filled then the submission will be rejected after submitting it to HMRC.

- In case there are more than one open obligations available then the oldest needs to be submitted first. Otherwise the VAT return will be rejected due to invalid VAT return period.

- When the VAT return has been submitted to HMRC the response of HRMC, to determine whether the submission has been rejected or approved will be automatically updated. The use of the button Check Status is not needed.

- When the MTD gateway is used for submitting the VAT return then while submitting, the user will see a message which needs to be accepted. The type of message depends on whether you are an agent or business. In case the message is cancelled the VAT return is not submitted. When Document Management is used to submit multiple VAT returns in once by using the MTD gateway, then per company this message will be shown and needs to be accepted.

Other remarksAfter 18 months the authorisation expires automatically and you need to authorise again. When the authorisation is expired you will be informed when submitting the VAT return.

When the VAT return has been accepted or rejected by HMRC the status of the submission will change accordingly. It is also possible to manually approve or reject the VAT submission. This option should not be used when sending the VAT return to HMRC, because then you are not able to see afterwards whether it has been manually approved or by HMRC. This was already existing functionality and have not been adjusted in relation with MTD.

Causes when VAT return is rejected

- Incorrect VAT return period selected. An obligation has been selected which is not open at HRMC. So please select the right obligation (period).

- The client and/or agent is not authorised. Please check the status of the MTD gateway or check whether VAT Reference Number from Company Settings is registered at HMRC and the correct VRN number is entered in the company settings.

- After 18 months you need to authorise again at HRMC, so please authorise again for MTD HRMC gateway in [VAT, Gateway].

- Incorrect VAT number – Please check if the correct VAT Reference Number has been entered in Company Settings.

- User has already submitted a VAT return for the given period. An obligation has been selected which has already been submitted to HMRC. Please select the right obligation/ VAT return period.