This article is part of this article serie:

API Best PracticesTake a look at the steps below:

- Great Furniture Ltd. just sold a table to John and sends him an invoice.

- A sales transaction is created for this invoice in Twinfield.

- John pays the invoice by bank.

- Great Furniture Ltd. receives a bank statement in Twinfield.

- Great Furniture Ltd. matches the bank statement with the sales transaction in Twinfield.

In this example the sales transaction will be matched with the bank statement during step 5. We can say two things about this sales transaction:

- Before step 5 the sales transaction is "unmatched". Therefore we can consider it unpaid.

- After step 5 the sales transaction will be "matched". Therefore we can consider it paid.

When you want to know if a sales transaction is paid, then you should check if a sales transaction is matched or unmatched. The same applies to purchase transactions.

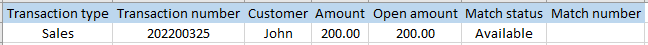

At step 2 the sales transaction is added to Twinfield. Notice the columns Amount and Open amount in the table below. Amount shows the original invoice value. Open amount shows the the value that John still needs to pay. Notice that the match status mentions Available. This means that the sales transaction is "available for matching" (which means that it is still unmatched).

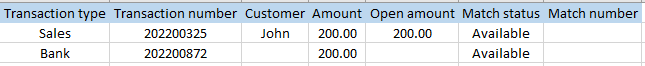

At step 4 the bank statement is received in Twinfield. At this moment it's not yet known that the amount of 200.00 in the bank statement belongs to sales transaction 202200325.

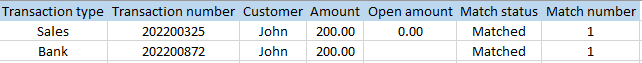

At step 5 the statement is matched with the sales transaction. Notice that the bank statement is now registered as belonging to John. Also notice that the open amount in the sales transaction has been set to 0.00 and the amount of the sales transaction still shows original invoice amount of 200.00. Both transactions have the match status Matched and both have the same match number.

Good to know: The combination "customer plus match number" can be used for identifying which bank statement was used for paying which sales transaction. In this case the combination is "John 1".

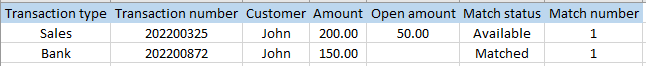

Keep in mind that John could also partially pay the invoice. The original invoice amount is 200.00. Suppose John pays 150.00. In this case the 150.00 of the bank statement will be fully matched with the sales transaction. In this case the sales transaction will be left with an open amount of 50.00. The match status of a transaction will remain Available as long as the total amount hasn't been matched.